Preparing for the New Overtime Pay Rule

Big changes are coming to over-time policy. As noted in Accounting Today, in 2015 the Department of Labor proposed a rule change that will have a monumental impact on the way employers compensate their employees for over-time. The rule change raises the overtime exemption threshold under the Fair Labor Standards Act (FLSA). The final version of this rule change is not expected to be released until late 2016.

The revised regulations, which are estimated to affect more than 5 million American workers, will increase the salary threshold for the overtime exemption from $455 a week ($23,600 annually) to $970 a week ($50,440 annually).

This will eventually increase the number of employees eligible to receive overtime pay. Under the old rule, only employees earning up to $23,500 annually could be entitled to over-time pay. Under the new increased exemption threshold, employees earning less than or equal to $50,440 annually will be entitled to over-time pay.

The rule change will impose financial and non-financial burdens on employers as businesses work to have full compliance with the FLSA and thereby avoid penalties and lawsuits for non-compliance.

Financially, it will add the burden of increased payroll costs. Therefore, more attention should will need to be devoted to managing cash flow requirements.

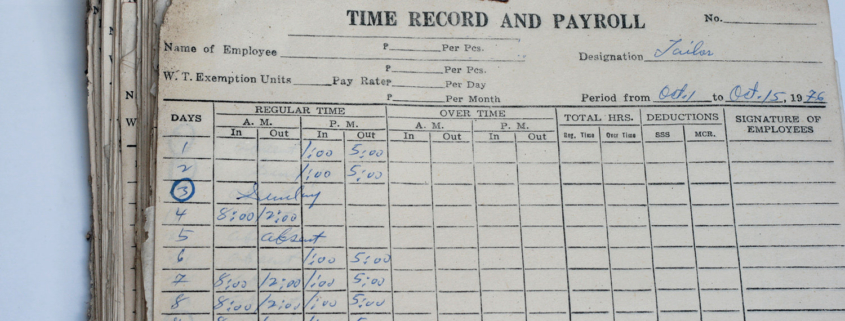

Attention should also be given to determine which positions will transition to non-exempt status. Employers will need to decide whether to just go with the flow, increase the salary level to maintain exempt status, or transition the position to non-exempt status. In addition, updating recordkeeping requirements and procedures can be critical to ensure full compliance with the Fair Labor Standards Act and applicable state wage and hour laws.

Thanks to the apparent uproar and number of negative comments invited by the DOL over its proposed change in the regulations, there appears to be growing speculation, however, that the terms of the final overtime threshold rule will be significantly different than as originally proposed.

Note the following differences in the initial proposed terms of the regulation change as quoted in HRMorning:

- The minimum salary threshold will rise to at least $40,000, instead of an initial increase to $50,440.

- The threshold will be tied to an automatic index so major legislative changes are not needed every time lawmakers want it to increase.

- The agency is considering changes to the duties tests, though at this point it is only asking for comments. The duties tests would be applicable to the executive, administrative, professional, computer or outside sales categories.

Of course, there is one big caveat to all of this. The new overtime rule will not be issued until late 2016, which means it probably won’t take effect until 2017. The presidential elections could completely change the landscape. The new over-time rule has been crafted and championed by Obama and the Democrat Party. If there is a shift in power in November, everything mentioned above could be in flux.