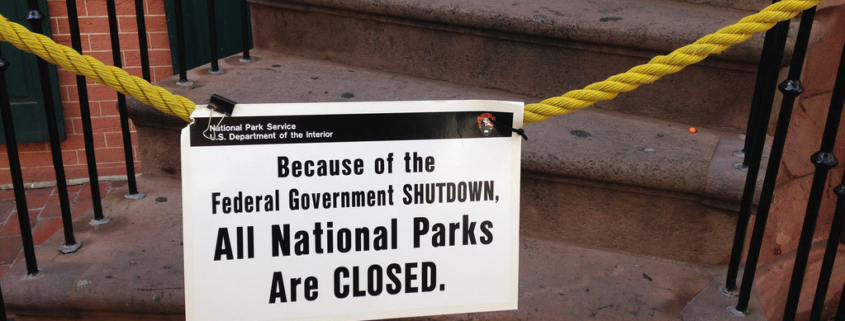

Government Shutdown Delays 2014 Tax Season

How does the government shutdown impact the IRS?

The 16-day government shutdown came at a pivotal time for the IRS as they were prepping their complex systems for the 2014 tax season. Only 10% of IRS were open during the government shutdown. This put the IRS behind by almost 3 weeks.

The tax date that taxpayers could start filing was January the 21st. Now with the delay, the IRS will not be accepting returns until at least January 28th–however no later than February 4th. The IRS will be confirming the dates sometime in December.

IRS systems are highly complex as they need to be altered every year to accommodate new tax laws. This requires an enormous effort from a programming and quality assurance perspective. The IRS had also increased the workload as they were stepping up measures to better identify fraud and inaccuracies.

We’re always up to date on what is going on with the IRS and how the shutdown has impacted new tax laws and the tax season timeline. We’re always happy to help you navigate your tax situation by planning and preparing you for the 2014 tax season.

Image courtesy of Shan213 on flickr; reproduced under Creative Commons 2.0