Forms 1095B & 1095C ACA Compliance Extended

Pursuant to the terms and requirements of the Affordable Care Act (“ACA”), Forms 1095B and 1095C must be prepared and filed by certain employers and provided to employees by a statute specific time in order to be in full compliance with the ACA.

Form 1095-B, Health Coverage

Form 1095-B is used to report certain information to the IRS and to taxpayers about individuals who are covered by minimum essential coverage and therefore are not liable for the individual shared responsibility payment.

Every person that provides minimum essential coverage to an individual during a calendar year must file an information return reporting the coverage. Filers will use Form 1094-B (transmittal) to submit Forms 1095-B (returns). However, employers (including government employers) subject to the employer-shared responsibility provisions sponsoring self-insured group health plans generally will report information about the coverage in Part III of Form 1095-C instead of on Form 1095-B.

For 2015 tax returns, everyone employed by a company with 50 or more employees will receive a new Form 1095. This form is in addition to the Form 1095-A received by other taxpayers using the marketplace to purchase their health insurance. You need this form to file your taxes as it provides the necessary proof that you have adequate health insurance for the year. Without this proof you could be subject to the new shared responsibility tax.

Form 1095-C, Employer-Provided Health Insurance Offer and Coverage Insurance

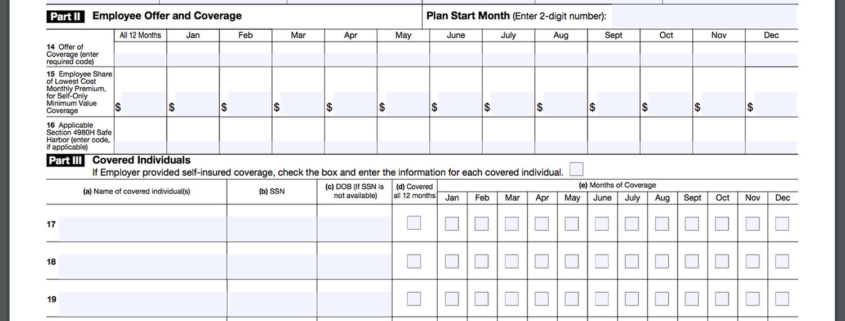

Form 1095-C is filed and furnished to any employee of an ALE member who is a full-time employee for one or more months of the calendar. ALE members must report that information for all 12 months of the calendar year for each employee. ALE is the abbreviation for Applicable Large Employer.

Applicable Large Employers, generally employers with 50 or more full-time employees (including full-time equivalent employees) in the previous year, must file one or more Forms 1094-C (including a Form 1094-C designated as the Authoritative Transmittal, whether or not filing multiple Forms 1094-C), and must file a Form 1095-C for each employee who was a full-time employee of the employer for any month of the calendar year. Generally, the employer is required to furnish a copy of the Form 1095-C (or a substitute form) to the employee.

Form 1094-C must be used to report to the IRS summary information for each employer and to transmit Forms 1095-C to the IRS. Form 1095-C is used to report information about each employee. The information reported on Form 1094-C and Form 1095-C is used in determining whether an employer owes a payment under the employer shared responsibility provisions under section 4980H. Form 1095-C is also used to determine the eligibility of the employee for the premium tax credit.

Extended Reporting Time Frame To Employees

As noted by this tax professional, a crucial driver to being in full compliance with the ACA is timely reporting of requisite 1095B and 1095C information to affected employees. Special note should be made to the fact that the IRS has granted an extension for Form 1095 B and 1095 C being sent to employees. The following table summarizes the impact of the statutory extension of time to report to employees.

Note: This delay does not impact the timing of Form 1095 A, Health Insurance Marketplace Statement. 1095 A is the form you receive if you purchase your health insurance through the Marketplace and not through your employer. http://news.resourcesforclients.com/index.php?u=NGdrUR4YvtBw&issue=78